Year 13 Students Build Financial Confidence at NatWest Workshop

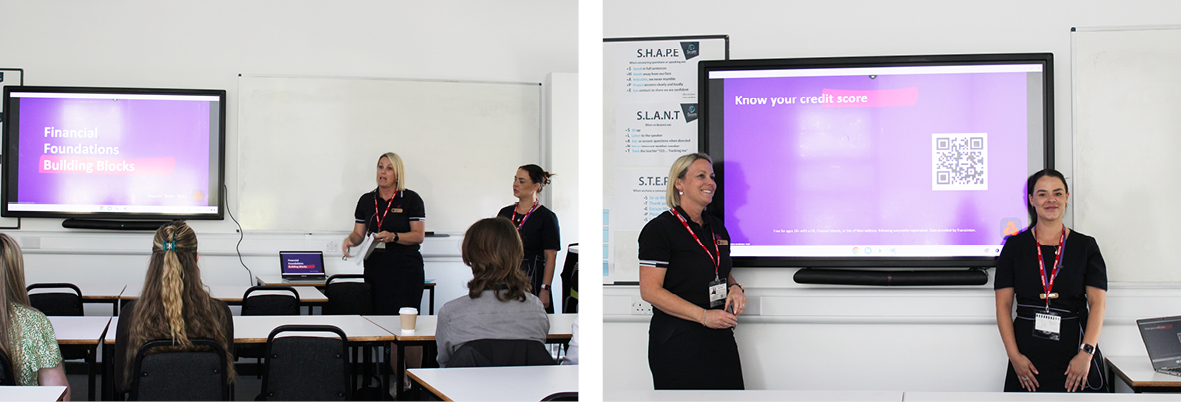

As part of our recent Curriculum Collapse session, Year 13 students took a valuable step toward financial independence by attending an informative Finance Workshop, delivered by guest speakers Brooke Morrison-Hill and Samantha Regis from NatWest Bank. The session was designed to equip students with essential knowledge and practical tools to help them navigate key aspects of personal finance as they prepare for university, apprenticeships, or the world of work.

The workshop focused on several important areas of personal finance, including the different types of bank accounts—particularly student accounts—as well as budgeting, money management, and credit scores. Students were introduced to how credit scoring works, why it matters, and how it can impact everything from mobile phone contracts to future mortgage applications.

A particularly eye-opening moment for many students was learning about the broader role banks can play in supporting financial wellbeing. Beyond traditional banking services, NatWest also offers financial health checks and one-to-one advice to help individuals make informed, confident decisions about their finances.

Designed to be open, honest, and interactive, the session encouraged students to ask questions and engage in meaningful discussion. The NatWest team shared clear, relatable examples and treated students as young adults, helping to create a respectful and engaging learning environment.

Reflecting on the experience, Jack in Year 13 shared: “I found it really useful how open and honest the team from NatWest were. They treated us maturely and took the time to explain all the options available to us. I especially appreciated learning about credit scores and how they impact the wider economy. It really opened my eyes to how important it is to understand your finances early on.”

Workshops like this are an important part of our commitment to preparing students not just academically, but practically, for life beyond school. We’re grateful to NatWest for delivering such an informative and empowering session.